From German Tax Tool to Global Finance Hub: Obolus 2026

from obolus finanz Team

Borderless Financial Planning

Obolus has evolved. What started as a dedicated tool for German wage tax has now transformed into a comprehensive Global Finance Suite. In an era of global mobility, your financial tools should be as flexible as your career.

Full Support for 8 Key Jurisdictions

We have integrated deep tax logic for the most sought-after international locations:

- Europe: 🇩🇪 Germany (2026 Update), 🇦🇹 Austria, 🇨🇭 Switzerland, 🇮🇪 Ireland

- Global: 🇺🇸 USA, 🇬🇧 UK, 🇨🇦 Canada, 🇦🇺 Australia

Introducing TaxCompare

The highlight of this shift is our new /taxcompare page. It allows you to visualize the tax burden across all 8 supported countries at a single glance. It’s the perfect dashboard for expats and nomads to optimize their take-home pay.

The Financial Ecosystem

This update connects the dots of your financial journey:

- TaxApp: Calculate your accurate net income worldwide.

- Budgeting: Seamlessly import your income into your personal budget.

- Investing: Project your wealth based on actual, tax-adjusted savings.

The future of Obolus is global. Welcome to borderless finance.

Furthermore, this new functionality also offers new statistical possibilities.

Here, for example, are the tax rates of a single person without children in international comparison:

International Tax Comparison

Visualization of net income relative to increasing gross salary by country.

Income Tax Class, Child Allowance & Co.: The most common mistake when calculating net salary in Germany.

from obolus finanz Team

The Illusion of a Simple Gross-Net Calculation Anyone planning a job change or negotiating a salary increase in Germany quickly turns to an online gross-net calculator. However, simply entering the "Gross" amount and "Tax Class" often provides a dangerously inaccurate figure.

The Problem: The complex and constantly changing German tax rules make a quick, blanket estimate nearly impossible. The most common mistake is ignoring the subtle but financially significant individual factors.

Why €100 Gross is not always €50 Net German wage and salary accounting is an interplay of federal laws, regional statutes, and personal decisions. The major sources of error in online calculators and estimates are:

1. The Complexity of Income Tax Classes (and why Class VI can be a shock) Tax Classes I through V seem straightforward, but when it comes to secondary jobs or the combination of employment relationships, the often-underestimated Tax Class VI quickly comes into play. Without tax-free allowances, this immediately leads to a massive tax deduction – a shock if you haven't budgeted your net income correctly.

2. The Silent Factor: Church Tax and Solidarity Surcharge (Soli) The Church Tax (depending on the federal state, 8% or 9% of the income tax) is often forgotten or calculated incorrectly. The Solidarity Surcharge (Soli) – although abolished for most – still applies if the income is above the exemption limit. A simple calculator often doesn't account for these individual thresholds precisely enough.

3. The Child Allowance: Not a Net Increase Many users mistakenly assume that entering the Child Allowance (Kinderfreibetrag) immediately increases their monthly net salary. This is false. The tax-free allowance only affects the calculation of the Solidarity Surcharge and the Church Tax. The actual financial relief comes later, through the income tax return and the Child Benefit (Kindergeld). Our planner allows the difference between Child Benefit and/or Child Allowance to be calculated.

Our Solution: Data Privacy Meets Precision We built ObolusFinanz to counteract these problems. Unlike the large portals that often collect data for advertising purposes, we offer you a calculator that keeps three promises:

Data Privacy Guarantee: We do not collect any personal data, do not use cookies for data analysis, and do not require registration. Your financial planning remains private.

German Precision: Our algorithm takes into account all current tariffs and thresholds to reliably map the complexity of the German system.

Focus on the Essentials: We quickly provide you with the net figure, without unnecessary advertising or confusing graphics.

Plan your finances with the accuracy they deserve. Try it now: Find out how much you will truly keep from your next job offer, or run scenarios for your secondary job.

Spousal Splitting in International Comparison: History, Criticism, and Practice

from obolus finanz Team

Introduction

The so-called spousal splitting (Ehegattensplitting) is a central component of German income tax law. It regulates how married couples or registered partners can be taxed jointly. At its core, the splitting procedure means that the total taxable income of both partners is added together, then halved, and taxed according to the progressive tax rate. The tax for the halved income is then doubled. This method "smooths" the tax progression and provides tax relief for households with significantly different income levels.

Historical Background

Spousal splitting was introduced in 1958 after the Federal Constitutional Court declared the previous "household taxation" system unconstitutional. The judges argued that tax law must recognize marriage as an equal partnership. With splitting, the legislature aimed to ensure that married couples would not be in a worse tax position than single individuals.

Over the decades, the splitting procedure has become a permanent part of German tax law, yet it has faced increasing controversy. Critics see it as favoring traditional role models where one partner earns the main income and the other works little or not at all. For secondary earners, often women, the model can bring financial disadvantages and make employment less attractive.

International Comparisons

A look abroad shows that Germany is rather an exception with its splitting procedure.

France: Here, the "Quotient Familial" is used, which considers not only the income of spouses but also children. The income is divided by "family shares" and then taxed, which particularly benefits large families.

USA: Married couples can choose between joint filing and separate filing. Under the joint filing option, they benefit from more favorable tax brackets, though to a lesser extent than in Germany.

Austria & Scandinavia: These countries follow the principle of individual taxation. Each spouse is taxed independently of the other; only child and family allowances provide tax relief.

Germany is therefore one of the few countries that practice joint taxation with significant benefits for couples with income disparities.

Criticism and Discussion

Proponents see splitting as an important recognition of marriage and a relief for families. Opponents criticize that it benefits households without children just as much as families with children. Furthermore, it reinforces the "sole earner + secondary earner" model and hinders equality in the labor market.

Choosing Tax Classes for Married Couples

In addition to the splitting procedure, the choice of tax classes also plays a role in Germany. Married couples can choose between the combinations IV/IV and III/V:

Combination IV/IV: Both partners are treated equally. This is particularly useful when incomes are similar. A factor must be specified. How this is calculated is often intimidating, but later in this article, we will show you how to calculate this value comprehensibly.

Combination III/V: The higher-earning partner benefits from lower monthly deductions (Class III), while the lower-earning partner is more heavily burdened (Class V). This often leads to a higher monthly household net income but can result in tax payments at the annual tax return.

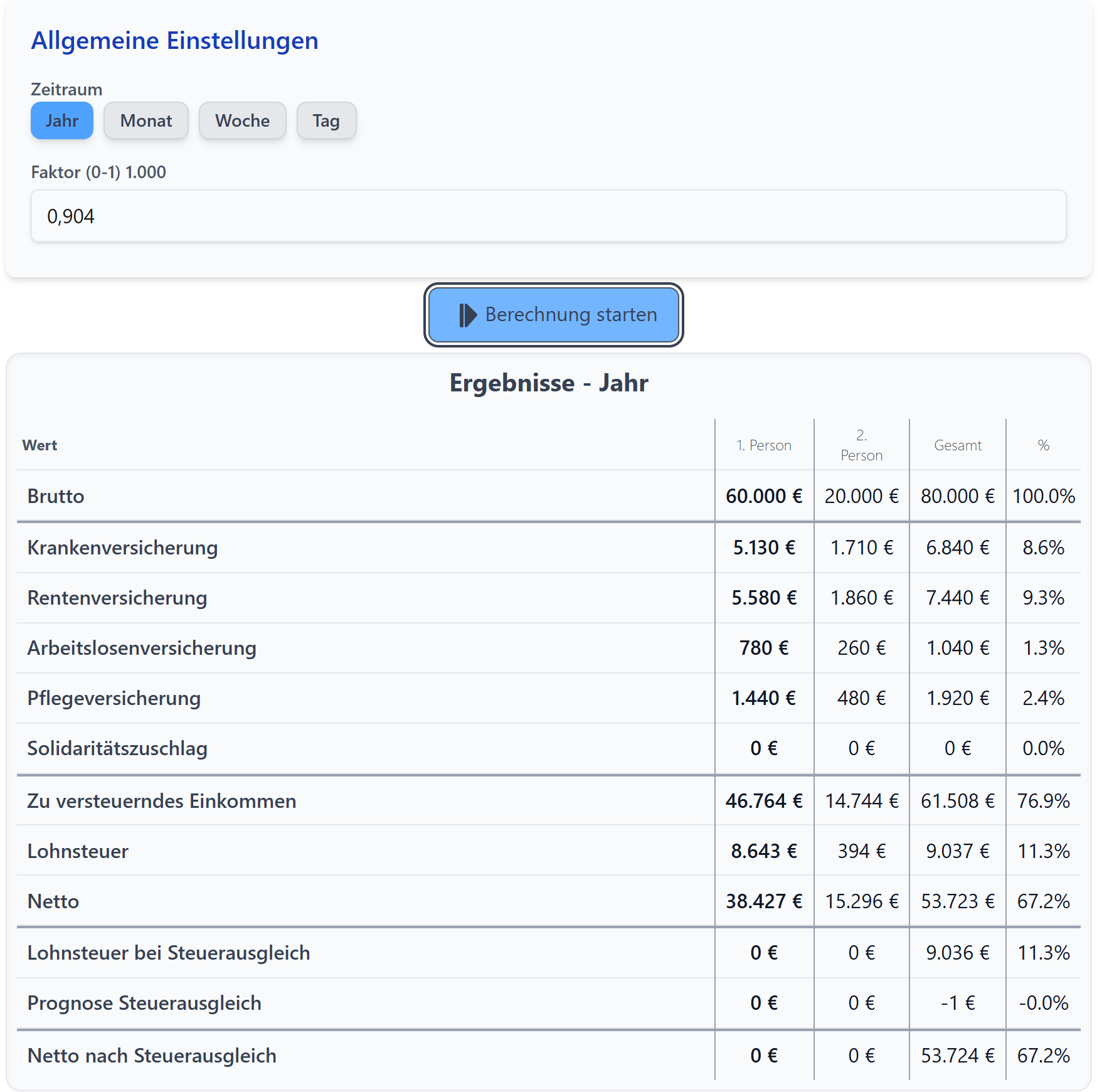

The final tax liability is calculated anyway within the annual income tax return using the splitting procedure. Which model is more beneficial in practice depends on the income ratio—this is where a calculation example comes in handy to illustrate the differences. We use our gross-to-net calculator to compare two typical income scenarios for a married couple:

Partner 1 Income: €60,000 - Partner 2 Income: €20,000

Tax Result Tax Class 3+5

Tax liability prepaid: €7,333. Tax liability at settlement: €9,036. A supplementary payment of €1,703 is to be expected. (Normally, a prepayment for the next tax settlement is set by the tax office from a supplementary payment of €400.)

Tax Result Tax Class 4+4 Factor 1

Tax liability prepaid: €9,997. Tax liability at settlement: €9,036. A tax refund of €961 is to be expected.

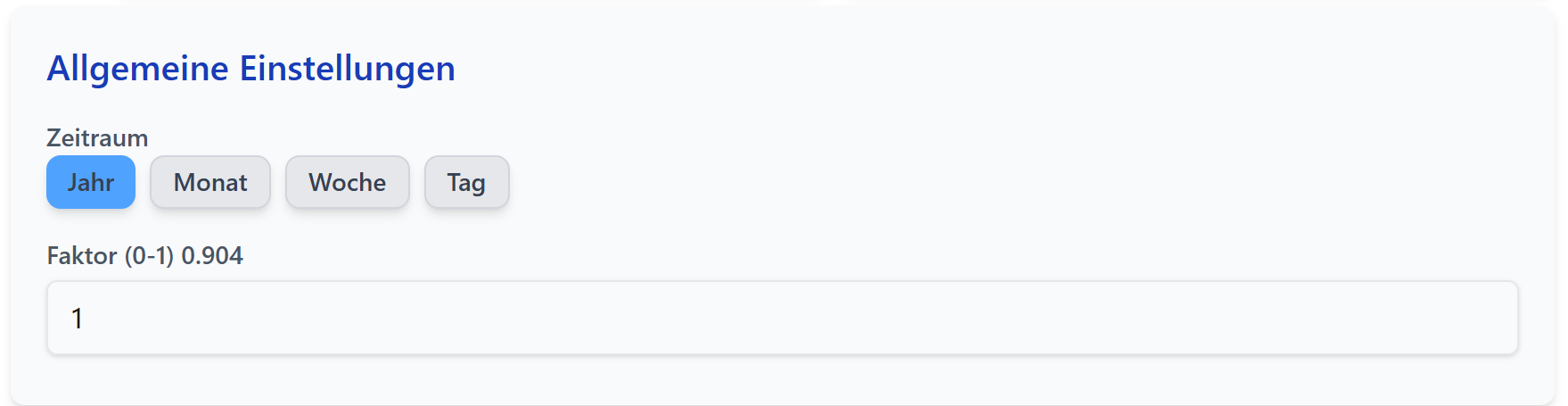

If we now look at the factor field in the app, we see a calculated value:

Here we can read the value that allows us to achieve a payroll deduction adjusted to the expected tax liability.

The result then looks like this:

Tax liability prepaid: €9,037. Tax liability at settlement: €9,036. A tax refund of €1 is to be expected.

You can register the calculated factor with your tax office to achieve a more suitable adjustment.

Conclusion

It must be stated that spousal splitting with tax classes 3/5 provides some relief for certain family constellations. However, this relief is often only a pleasant effect on the monthly payroll deduction, while the annual tax settlement often results in unpleasant supplementary payments and subsequent prepayments. The proposed solution, tax class 4/4 with a factor, is a viable one. However, setting a static factor is initially complex and opaque. Afterward, it is a secure solution as the tax prepayment aligns with the tax liability. However, problems arise when the income ratio between the spouses changes. In that case, the factor needs to be adjusted regularly.

This is particularly common for spouses with young children and resulting childcare responsibilities.